Risk Management in Options Trading

Options trading, carries with it a unique set of risks. Managing these risks is crucial for the long-term success of any trader.

August 1, 2023

Options trading, while offering diverse strategic opportunities, carries with it a unique set of risks. Managing these risks is crucial for the long-term success of any trader. Here's a guide to understanding and navigating these challenges effectively.

1. Understand the Basics: Before delving into advanced strategies, ensure you have a solid grasp of the basics. Recognize the intrinsic and extrinsic values, the Greeks (Delta, Theta, Vega, Gamma, and Rho), and how they affect an option's price.

2. Position Sizing: One of the most common mistakes is risking too much capital on a single trade. A general rule of thumb is to risk only a small percentage (e.g., 1-2%) of your total portfolio on any single options trade.

3. Diversification: Avoid putting all your capital into one underlying asset or one type of option strategy. Diversifying your options portfolio can help mitigate risk. This includes diversifying among different expiration dates, strike prices, and underlying assets.

4. Use Stop Losses: While more difficult with options than with stocks, setting a limit on how much you're willing to lose on a particular trade can prevent catastrophic losses.

5. Be Wary of Leverage: Options, by nature, offer leverage. This means that while they can amplify returns, they can also amplify losses. Always be conscious of the leverage you're employing in your options portfolio.

6. Stay Updated: Things like earnings reports, major geopolitical events, or central bank decisions can drastically affect an option's price. Always stay informed about events related to the underlying asset.

7. Avoid Emotional Trading: Stick to your predefined strategy and avoid making impulsive decisions based on fear or greed. If a trade is not going as expected, evaluate it rationally rather than emotionally.

8. Review and Learn: Regularly review your trades. Whether you gained a profit or incurred a loss, there's always something to learn. By understanding what went right or wrong, you can refine your strategies and avoid making the same mistakes.

9. Limit Time Decay Exposure: All options lose value over time, a phenomenon known as Theta or time decay. Be mindful of the impact of Theta, especially when dealing with short-term options.

10. Hedge When Necessary: If you're in a position where a potential loss might be too significant, consider hedging. This might involve using different options strategies or other financial instruments to offset potential losses.

11. Keep Some Cash Reserves: Having a portion of your portfolio in cash gives you flexibility. It allows you to take advantage of new opportunities and provides a cushion if things go south.

12. Avoid Overcomplication: While advanced options strategies can be enticing, they come with increased risk and complexity. Don't use a strategy unless you fully understand its implications.

Conclusion:

Risk management is an ongoing process. It's not about eliminating risks but rather understanding and mitigating them. By incorporating these principles, options traders can make more informed decisions, protect their capital, and position themselves for long-term success.

Remember, options trading isn't suitable for every investor, and losses can exceed your initial investment. Always consult with a financial professional before diving into the world of options trading.

Enhance Your Financial Strategy – Reach Out for Personalised Advice!

Are you a HNI, SME/Startup or a Proprietary Trading Firm Looking to Manage your Wealth?

Schedule a demo to explore how our solutions can help you manage and grow your wealth effectively.

Recent blogs

Momentum Investing

Momentum Investing buys stocks with recent price gains to ride their upward trend and avoids those with declining prices.

June 21, 2024

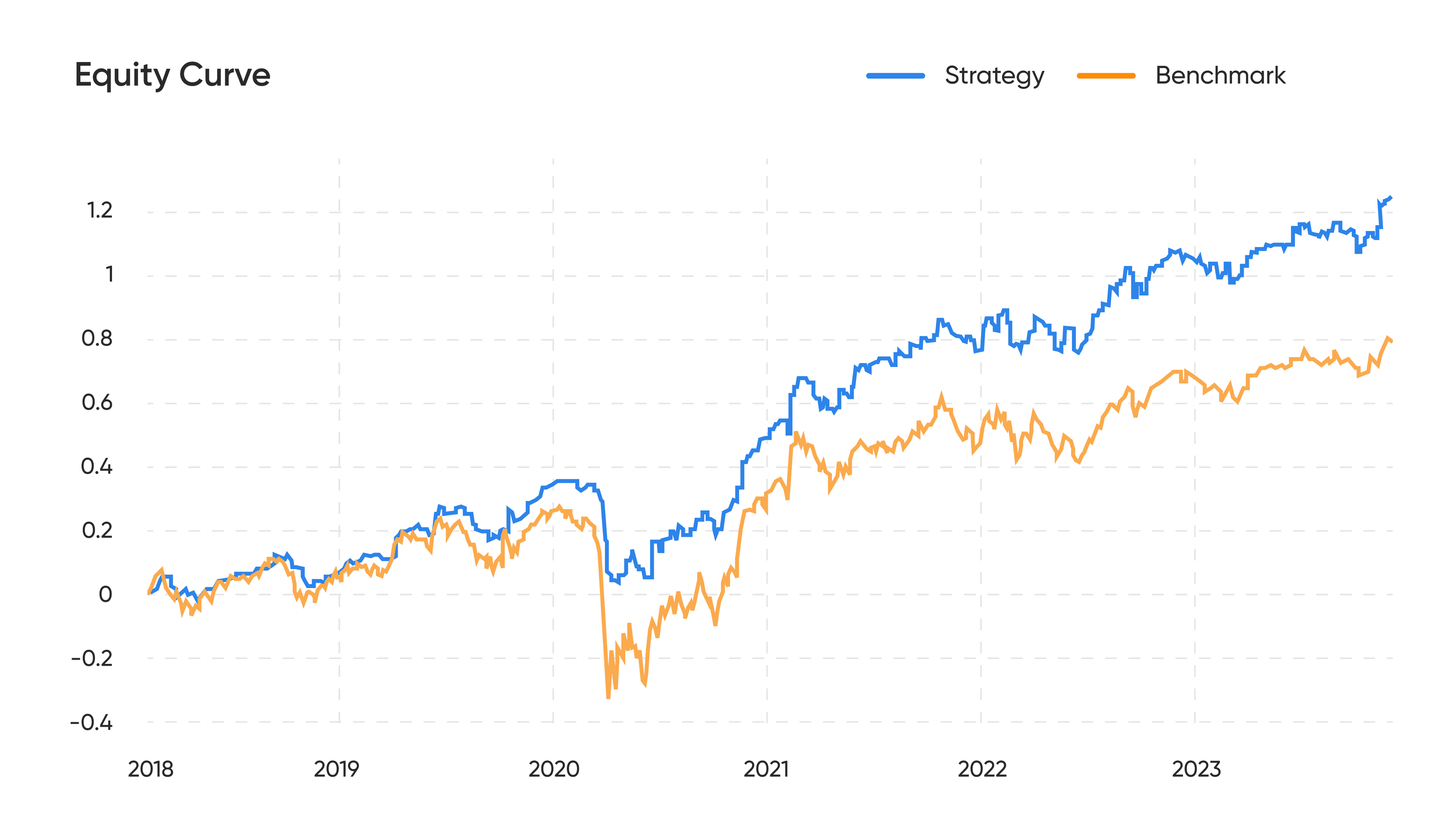

Generating Alpha on broad market Index

Is it feasible to beat the market? The article tests hedging concepts to manage the downside and generate alpha on Index.

February 9, 2024

Selling Options No Longer Rewarding in the Indian Markets?

India Vix of the IV of Nifty is at an all-time low.

September 11, 2023

Algo Trading: Ultimate Beginners Guide 2023

Executing strategic algorithms to automate trading decisions and optimize financial portfolios in real-time.

February 1, 2024

Covered Calls to Reduce Stock Purchase Cost

Options can be effectively used to reduce the effective cost of purchasing stock.

September 1, 2023

Options Hedging: Safeguarding Your Investments

Hedging is an investment technique used to reduce the risk of adverse price movements in an asset.

September 1, 2023

Risk Management in Options Trading

Options trading, carries with it a unique set of risks. Managing these risks is crucial for the long-term success of any trader.

August 1, 2023