Options Hedging: Safeguarding Your Investments

Hedging is an investment technique used to reduce the risk of adverse price movements in an asset.

September 1, 2023

The financial world is fraught with uncertainties. Just like an umbrella shields you from rain, hedging in the world of options can be a protective measure against unforeseen market movements. This blog post will explore the ins and outs of options hedging, its significance, and some popular strategies employed by traders.

What is Hedging?

Hedging is an investment technique used to reduce the risk of adverse price movements in an asset. Essentially, hedgers use instruments like options to protect against potential losses in their portfolio.

Why Hedge with Options?

- Flexibility: Options provide the flexibility to hedge against both upward and downward price movements.

- Cost-Effective: Options often require a lower upfront investment compared to the underlying asset.

- Defined Risk: With options, the maximum risk is the premium paid, allowing for better risk management.

Popular Options Hedging Strategies:

- Protective Put: This involves buying a put option for an asset you already own. If the asset’s price falls, gains from the put option can offset the losses from the asset.

- Covered Call: Here, an investor holding a long position in an asset sells call options on that same asset. This strategy generates additional income (the premium) but caps potential upside gains.

- Collar: A collar is a combination of a covered call and a protective put. It offers protection from significant declines while also providing income through the sale of the call option. However, it also limits potential upside.

- Index Options: For those with a diversified portfolio, hedging each stock individually might be cumbersome. Using index options, investors can hedge their entire portfolio against market downturns.

- Delta Hedging: This strategy aims to make an options position delta-neutral, meaning the position won't change in value for small changes in the underlying asset's price. It involves adjusting the number of options based on the delta.

Hedging Tips:

- Analyze Costs: While hedging provides protection, it's not free. Evaluate the costs associated with the hedge versus the potential benefit.

- Rebalance Regularly: As market conditions and your portfolio change, adjust your hedges accordingly.

- Stay Informed: External factors like interest rate changes, geopolitical events, or major economic announcements can impact the effectiveness of your hedge.

- Know Your Exit: Have a clear plan on when and how to unwind your hedge.

- Avoid Over-Hedging: Over-hedging can eliminate potential profits. Ensure you're using just the right amount of protection for your portfolio.

Conclusion:

While the idea of hedging sounds appealing, it's not a one-size-fits-all strategy. It requires careful planning, regular monitoring, and a deep understanding of the instruments being used. Nevertheless, when implemented correctly, options hedging can be a valuable tool in an investor’s toolkit, offering peace of mind in volatile markets.

It's crucial to remember that all investment strategies, including hedging, carry risks. Always consult with a financial expert to understand these risks and develop a plan tailored to your specific needs and objectives.

Enhance Your Financial Strategy – Reach Out for Personalised Advice!

Are you a HNI, SME/Startup or a Proprietary Trading Firm Looking to Manage your Wealth?

Schedule a demo to explore how our solutions can help you manage and grow your wealth effectively.

Recent blogs

Momentum Investing

Momentum Investing buys stocks with recent price gains to ride their upward trend and avoids those with declining prices.

June 21, 2024

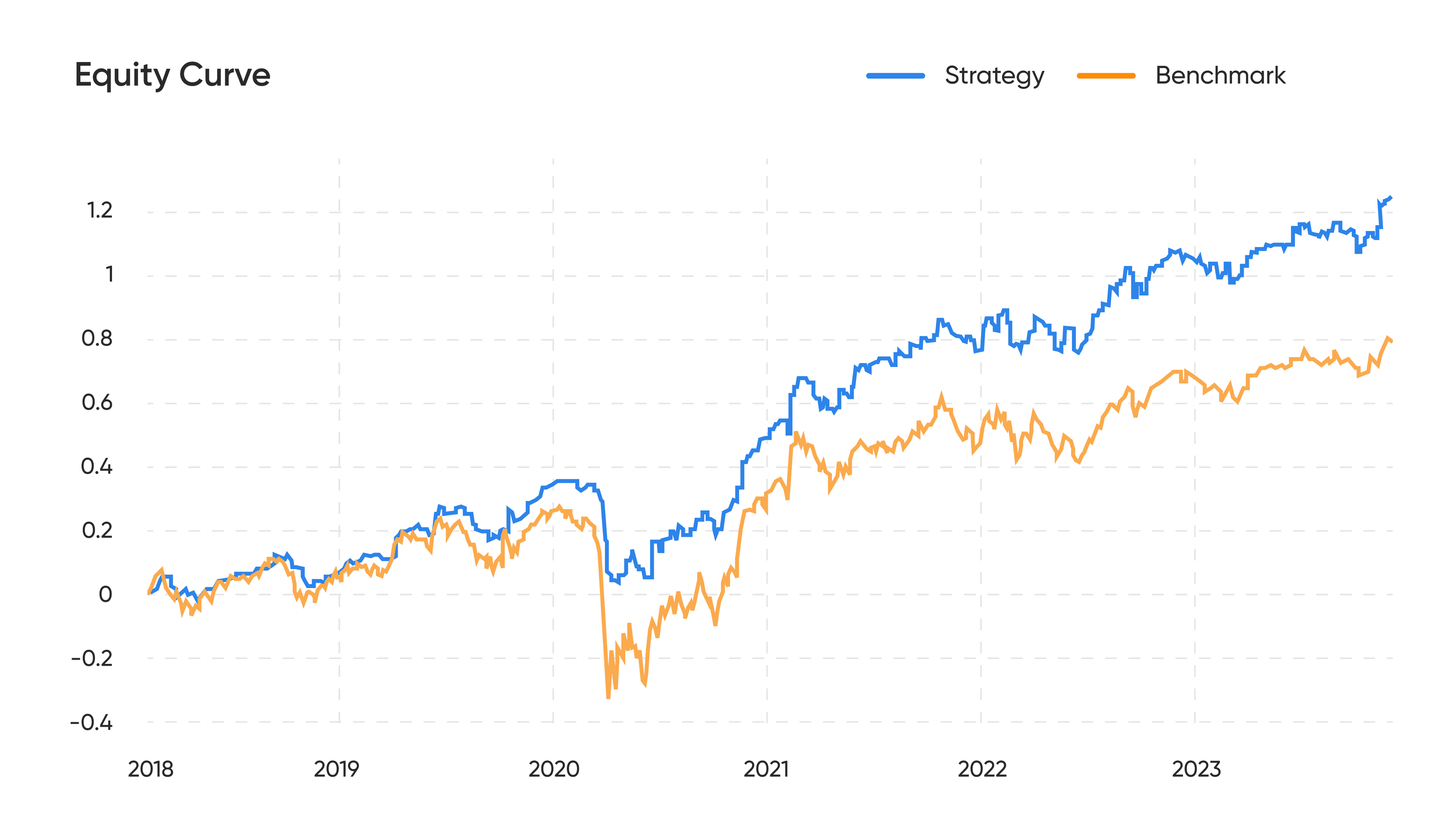

Generating Alpha on broad market Index

Is it feasible to beat the market? The article tests hedging concepts to manage the downside and generate alpha on Index.

February 9, 2024

Selling Options No Longer Rewarding in the Indian Markets?

India Vix of the IV of Nifty is at an all-time low.

September 11, 2023

Algo Trading: Ultimate Beginners Guide 2023

Executing strategic algorithms to automate trading decisions and optimize financial portfolios in real-time.

February 1, 2024

Covered Calls to Reduce Stock Purchase Cost

Options can be effectively used to reduce the effective cost of purchasing stock.

September 1, 2023

Options Hedging: Safeguarding Your Investments

Hedging is an investment technique used to reduce the risk of adverse price movements in an asset.

September 1, 2023

Risk Management in Options Trading

Options trading, carries with it a unique set of risks. Managing these risks is crucial for the long-term success of any trader.

August 1, 2023