Generating Alpha on broad market Index

Is it feasible to beat the market? The article tests hedging concepts to manage the downside and generate alpha on Index.

February 9, 2024

Generating a return which coincides with a broad index can just be done by buying an Index Fund which tracks the particular Index. ETFs aim is to replicate the performance of the underlying index by holding the same stocks in the same proportions as the index itself. In India there are several fund houses which offer investing to track the return of a particular Index like Nifty50, Banknifty among others. Most of these Index tracking funds are actively traded in stock exchanges - NIFTYBEES, BANKBEES etc., which enable the investor to buy and sell like stocks of any listed company. This strategy provides investors with exposure to a diversified portfolio of stocks within a particular market segment or index.

Nifty Bank Index compared with Bankbees ETF. If you see the graph, ETFs are efficiently being able to track the underlying Index.

Bank Nifty has given a return of 85% since the beginning of 2018 to end of 2023. Investors would have got the return just by Investing in an ETF, which translates to 12%-15% CAGR.

Is it possible to generate alpha over Index returns at same time minimizing the risk?

How to extract more out of it?

Let’s explore options contracts to see if we can get an Alpha.

The premiums available for BANKNIFTY ATM (At the Money) Call weekly contracts is around Rs.520 (45900 strike). The premium would vary based on the market volatility say from Rs.400 (low volatile market) to Rs.550. Let's assume Rs.450 as an average weekly premium.

This would translate into Rs.23,400 (450*52 weeks) per year, that is 50% of the underlying value. It means if BANKNIFTY remains at same level throughout the year, one could just gain 50% return assuming the premium would also be at Rs.450 every week. That’s hypothetical, what's fun in the market if there is no action!

But what will happen if we buy the ETF and sell ATM Call option contract and roll it over every week.

Here are some data on 1 January 2018

Bank Nifty Contract size 25

Bank Nifty Index close price - 25,318

BANKBEES ETF close price - 257.8

So to implement the strategy we would buy BANKBEES worth Rs.632,950 (25318*25 lot size) which translates to 2,455 qty of Bankbees.

Idea is to buy and hold Bankbees and sell and rollover weekly ATM call option contract. To sell an options contract you do not need additional margin as you can pledge your Bankbees. We would probably need 50% of the margin required to short an option contract in cash to meet brokers margin requirement and for withstanding MTM fluctuations (that is, approx Rs.100,000). Total investment we considering for the model is Rs.8 lakhs (Rs.6.33 lakhs +1 lakh+buffer).

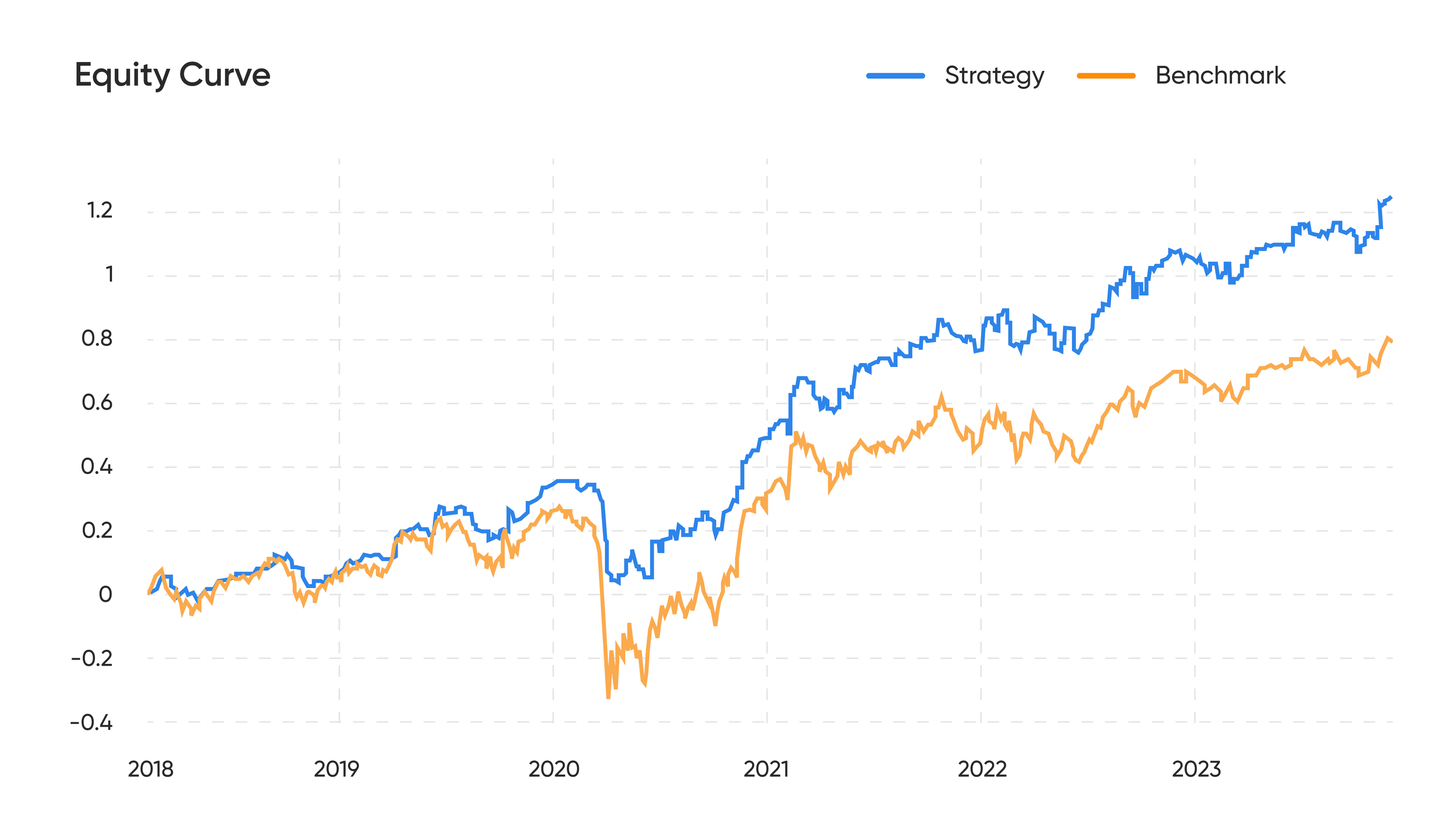

Bingo, the simple rollover strategy generated the return of 100% since 2018, an additional 20% over the Index.

As the idea behind writing a call option is to protect the downside by the tune of the premium. In case market moves up, it would restrict the gains up to the premium of the contract.

Let’s see how much downside was protected?

During covid crash the index lost up to 60% whereas the strategy was able to restrict the loss to 33%.

Can we generate more alpha?

Let’s try managing the options contract. In this approach, we try to improve upon the above strategy by incorporating a directional bias. Instead of rolling over the ATM call every week and limiting our profit potential during rallies, we intend to sell the call only when there is a loss of upside momentum and refrain from it during substantial rallies. The rationale behind this is to follow the prevailing market trend and hedge our investments only when it is required. This approach can be useful in reducing the hedging cost of our portfolio, thereby generating more potential profit. Let's look at the performance of the strategy over the same 5-year period:

We used our internal short term momentum model to identify the market cycle.

Here is an underwater plot.

Note: Income generated through selling the call option is not re-invested

The modified model generated 130% return against 80% in benchmark and 100% in simple rollover, while the max DD remained at 33% during covid but slightly improved in other times. Unutilised cash gains at the end of period is Rs.4L (8L*50%(130%-80%).

In conclusion, both the approaches showcase their effectiveness in managing drawdowns through the strategic use of selling call options. However, the second approach stands out for its ability to generate superior alpha while keeping drawdowns at the same level as the first approach.

At Inuvest, we research quantitative models to generate alpha and protect capital at the same time.

Do reach us at quants@inuvest.tech to know more about our models and how we leverage technology to generate an alpha.

Enhance Your Financial Strategy – Reach Out for Personalised Advice!

Are you a HNI, SME/Startup or a Proprietary Trading Firm Looking to Manage your Wealth?

Schedule a demo to explore how our solutions can help you manage and grow your wealth effectively.

Recent blogs

Momentum Investing

Momentum Investing buys stocks with recent price gains to ride their upward trend and avoids those with declining prices.

June 21, 2024

Generating Alpha on broad market Index

Is it feasible to beat the market? The article tests hedging concepts to manage the downside and generate alpha on Index.

February 9, 2024

Selling Options No Longer Rewarding in the Indian Markets?

India Vix of the IV of Nifty is at an all-time low.

September 11, 2023

Algo Trading: Ultimate Beginners Guide 2023

Executing strategic algorithms to automate trading decisions and optimize financial portfolios in real-time.

February 1, 2024

Covered Calls to Reduce Stock Purchase Cost

Options can be effectively used to reduce the effective cost of purchasing stock.

September 1, 2023

Options Hedging: Safeguarding Your Investments

Hedging is an investment technique used to reduce the risk of adverse price movements in an asset.

September 1, 2023

Risk Management in Options Trading

Options trading, carries with it a unique set of risks. Managing these risks is crucial for the long-term success of any trader.

August 1, 2023