Covered Calls to Reduce Stock Purchase Cost

Options can be effectively used to reduce the effective cost of purchasing stock.

September 1, 2023

Options can be effectively used to reduce the effective cost of purchasing stock, provided the trader is willing to take on certain risks and responsibilities. One common strategy to achieve this is the "Covered Call" strategy. Let's discuss it in more detail:

Using Covered Calls to Reduce Stock Purchase Cost

The Covered Call strategy involves two steps:

- Buying shares (usually in multiples of lot size) of a stock.

- Selling (or "writing") call options on those shares.

The premium received from selling the call options can be viewed as income or a discount to the cost basis of the stock purchase. The goal is to reduce the net cost of the stock, thereby providing a cushion against potential downside or enhancing returns if the stock remains stable or grows modestly.

How It Works:

- Buy Stock: First, purchase the shares of the stock or Index ETF. Let's say you buy 250 shares (equivalent of 1 lot) of RELIANCE (RIL) at ₹2452 per share, spending ₹6,13,000.

- Sell Call Option: Next, sell a call option with a strike price at the current stock price. For instance, you might sell a call with a strike price of ₹2460 that expires in a month, and for doing so, receive a premium of ₹40 per share, or ₹10,00 total.

The ₹10,000 premium received from selling the call option effectively reduces your cost basis in the stock from ₹613,000 to ₹603,000, or from ₹2452 per share to ₹2412 per share.

Possible Outcomes:

- Stock Rises Above Strike: If RIL rises above ₹2460 on expiry, the option will likely be settled in delivery, and you'll be obligated to sell your shares at ₹2460. In this case, you make a profit from the stock appreciation (up to ₹2460) plus keep the option premium, but you miss out on any gains above ₹2460. Please note that some brokers would square off your call option before the expiry to avoid delivery of shares. Please check with your brokers about their delivery policy. Another thing to note is if the call option is ITM then there could be possible liquidity issues and might lose money due to slippage or you may not be able to exit the option at the desired price. Make sure you deploy this strategy on highly liquid stocks or on Index ETF which are cash-settled.

- Stock Stays Below Strike: If RIL remains below ₹2460 until the option expires, the option becomes worthless, and you keep the premium. You can then sell another call option for the next period, continuing to reduce your stock cost basis.

- Stock Falls: If the stock price falls, the premium you received provides a cushion. In our example, even if the stock drops to ₹2412, you'd break even because of the ₹40 premium.

Considerations and Risks:

- Opportunity Cost: If the stock surges above the strike price, you miss out on potential gains above that price.

- Downside Risk: The premium received provides limited protection. If the stock drops significantly, you could still incur losses.

- Commitment: If your option is exercised, you must deliver the underlying stock, meaning your shares get sold whether you want to or not.

- Short-Term Focus: This strategy tends to be more short-term since you're selling options that expire, requiring regular management and decision-making.

Conclusion:

Using covered calls can be a smart way to reduce the cost basis of a stock purchase, but it's not without its risks. It's essential to understand the implications fully and be comfortable with the possibility of capping your upside or selling your stock if the options are exercised.

Always consult with financial professionals or conduct thorough research before implementing any options strategy.

Keep in mind, the numbers in the example are simplified for clarity, and in real trading scenarios, commissions and other factors might affect the net outcome.

Enhance Your Financial Strategy – Reach Out for Personalised Advice!

Are you a HNI, SME/Startup or a Proprietary Trading Firm Looking to Manage your Wealth?

Schedule a demo to explore how our solutions can help you manage and grow your wealth effectively.

Recent blogs

Momentum Investing

Momentum Investing buys stocks with recent price gains to ride their upward trend and avoids those with declining prices.

June 21, 2024

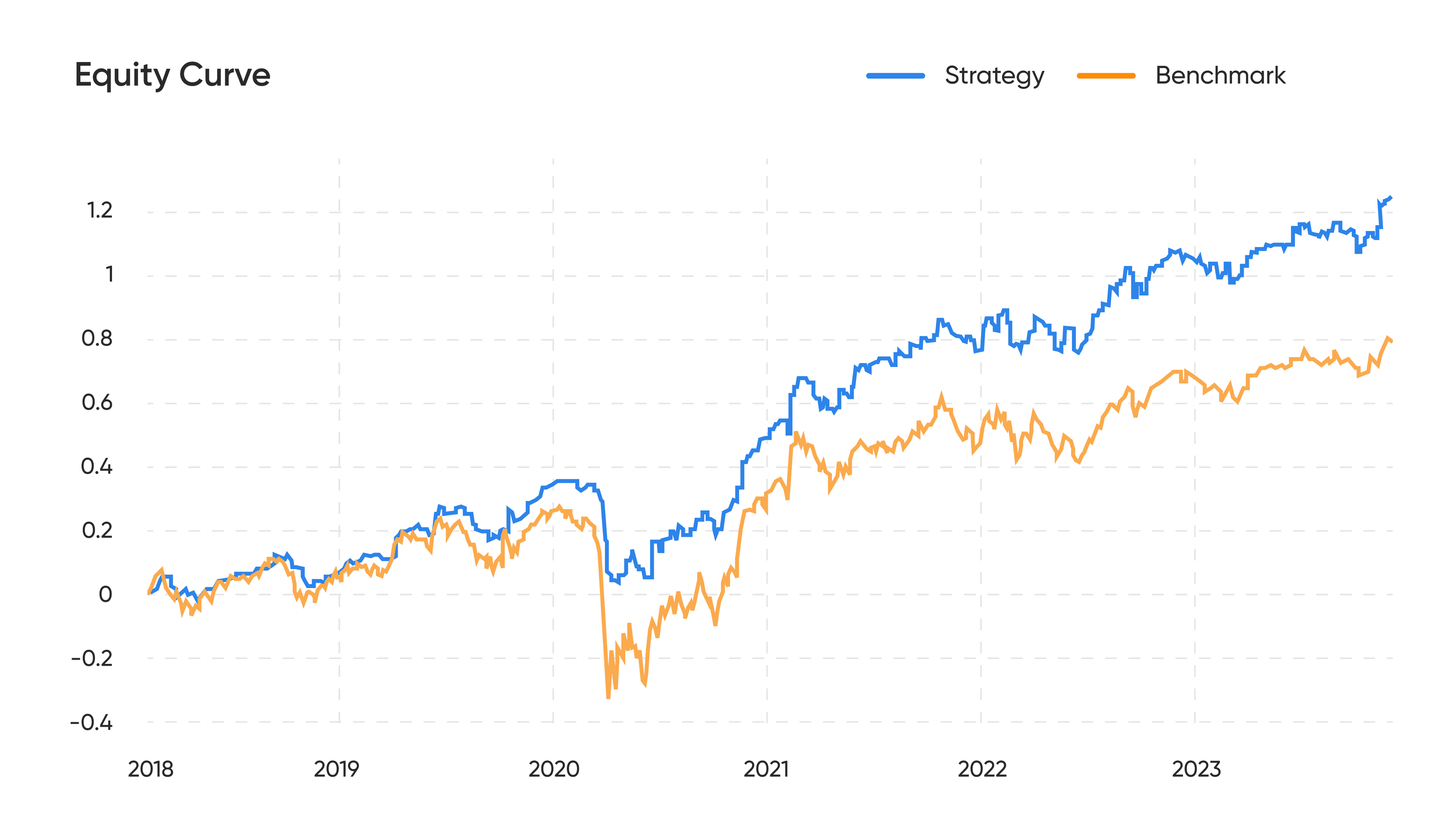

Generating Alpha on broad market Index

Is it feasible to beat the market? The article tests hedging concepts to manage the downside and generate alpha on Index.

February 9, 2024

Selling Options No Longer Rewarding in the Indian Markets?

India Vix of the IV of Nifty is at an all-time low.

September 11, 2023

Algo Trading: Ultimate Beginners Guide 2023

Executing strategic algorithms to automate trading decisions and optimize financial portfolios in real-time.

February 1, 2024

Covered Calls to Reduce Stock Purchase Cost

Options can be effectively used to reduce the effective cost of purchasing stock.

September 1, 2023

Options Hedging: Safeguarding Your Investments

Hedging is an investment technique used to reduce the risk of adverse price movements in an asset.

September 1, 2023

Risk Management in Options Trading

Options trading, carries with it a unique set of risks. Managing these risks is crucial for the long-term success of any trader.

August 1, 2023